Remittances or cross-border money transfers are one branch of financial services where Fintech has a far-reaching effect – quite literally. Remittances have evolved in parallel with new technology, growing significantly year-on-year.

Cross-border money transfer businesses offer a wide range of options such as cash payouts, account credits, mobile wallets, and even door-delivery services. With the rise of Fintech platforms, the process of sending money across borders has become faster, cheaper, and more convenient than ever before. Let’s understand the role of Fintech companies in shaping this evolving landscape and what are the impacts that we should consider.

Understanding Fintech

Fintech is a portmanteau for “financial technology”, and describes the growing use of new technology to deliver innovative financial products to both individual and business customers. Businesses rely upon Fintech for payment processing, e-commerce transactions, accounting, etc.

To put it simply, Fintech is exactly what you need if you aim to manage finances easily, and conveniently, even without the necessity to leave your home to check your bank account or transfer money.

Fintech companies compete directly with traditional banking services, to make financial transactions easier, quicker, and more cost-effective. The Fintech industry covers a wide area of financial services including lending, financial advice, wealth management, fundraising, insurance, money payments, currency transfers, and retail banking.

The Main Sectors of Fintech

Payments and Settlements

Some Fintech payment apps like PayPal, Venmo, Block (Square), Zelle, and Cash App make it easy to pay individuals or businesses online and in an instant. Besides, with the growth of blockchain technology, the concept of atomic settlements is promising to usher in a new era for secure, digital payments.

Consumer Finance

Consumer finance mentions the application of Fintech in credit and insurance. Peer-to-peer (P2P) lending platforms and marketplaces like Prosper Marketplace, LendingClub, and Upstart allow individuals and small business owners to receive loans from an array of individuals who contribute microloans directly to them.

Fintech in insurance – insurtech is the application of technology specifically to the insurance space. One example would be the use of devices that monitor your driving in order to adjust auto insurance rates.

Asset Management/Investments

Fintech has been applied to asset management/investments. Here are just a few examples.

Robo-advisors are apps or online platforms that optimally invest your money automatically, often for little cost, and are accessible to ordinary individuals.

Other investment apps like Robinhood make it easy to buy and sell stocks, exchange-traded funds (ETFs), and cryptocurrency from your mobile device, often with little or no commission.

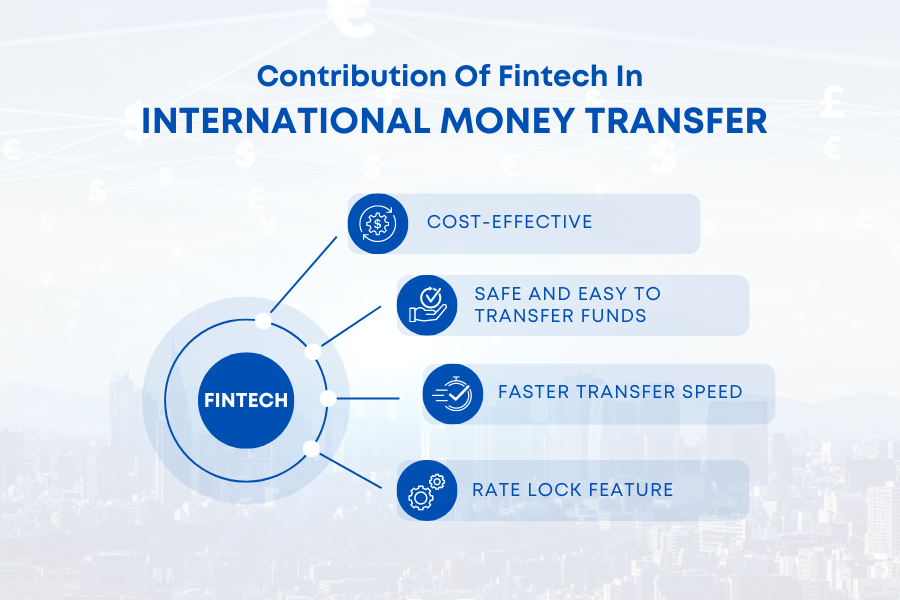

Contribution Of Fintech In International Money Transfer

Fintech companies are making international money transfers easier for customers. They’re also helping people send money abroad, which means that Fintech is contributing to standardising the global financial system.

Some case studies of applying Fintech in international money transfers include paying someone in another country with a single click of your mouse – TransferWise or transferring funds without paying fees when it’s convenient for both parties involved (like when one person pays his or her friend) – Azimo

Cost-Effective

One of the defining factors in cross-border transactions is the exchange rate and transaction costs. Fintech has reduced the cost of money transfers. For example, in the past, it cost $25 to send $200 from one country to another. Nowadays, you can send that same amount of money for just $10 or less depending on your country’s local exchange rate (the price of one US dollar in terms of another currency).

Fintech has also introduced new ways to send money that make it easier for people who don’t have access to traditional banks or financial institutions:

- Bitcoin cryptocurrency remittance services enable customers with no bank accounts at all, as well as those residing abroad, to send payments instantaneously over the internet.

- Mobile wallets such as Venmo allow people with smartphones instead of credit cards

Safe And Easy To Transfer Funds

Fintech companies have created a safe and easy way to transfer funds between different countries. While few banks may require in-person visits, extensive paperwork, and a time-consuming initiation process, Fintech companies offer a 24×7 online booking option for international money transfers. They offer a wide range of services including international money transfers, payments, loans, and more.

Faster Transfer Speed

The use of Fintech has greatly reduced the time taken by customers to receive their money transfer in most cases within just one hour which was normally up until now it takes 5-6 days before you receive your funds back into your account after sending them out from an overseas bank account through traditional channels like Western Union or Moneygram. This faster transfer speed is especially useful in time-sensitive situations, such as medical emergencies or urgent funds needs abroad.

Rate Lock Feature

A notable feature exclusive to many Fintech platforms is the rate lock option. For instance, the “Book Now & Pay Later” feature available on the BookMyForex platform allows users to freeze desired exchange rates for up to 3 days, providing flexibility and control over their transactions. This feature is absent in traditional banks, where users often have to make immediate payments at prevailing exchange rates.

Impacts That We Need To Consider

Cybersecurity And The Skills Gap

SMEs account for around 90 percent of the volume of B2B cross-border transactions, but financial literacy and associated digital capabilities are weaknesses for many SMEs. As these companies move from traditional to tech-based payment solutions, this skills gap highlights the potential for cybersecurity breaches, and for simple mistakes.

It’s a similar picture at many big firms, too. Larger organizations often lack comprehensive documentation, processes and knowledge in this area, and implementation is patchy.

The introduction of proper cybersecurity measures can also seem expensive and onerous. Firms require investment, training, discipline, policies, regular assessments and reviews. It can sometimes be hard to see the value, especially for an SME with limited resources or funds. That is often the scenario – until there is a breach.

Global cybercrime amounts to nearly $600 billion a year, according to Mordor Intelligence. That is equivalent to 0.8 per cent of global GDP. So, this is very much a real threat, and not an abstract or minor issue.

Moving forward, the skills issue runs deeper than baseline competency in the functional abilities of performing transactions. To succeed in this new world, related skillsets such as data processing and data analytics will also become important to businesses.

Legislation Consideration

The move to fintech solutions for cross-border transactions also brings new dynamics and stresses to existing legislative and regulatory frameworks. Answers to this vary across the globe. The situation is fragmented globally: not all countries have recognized this solution. Different nations are at different stages, and on different paths.

Conclusion

Fintech solutions are simpler, faster, and cheaper. And those are fundamental and game-changing qualities in any context.

Implemented and operated correctly, they will simplify processes, reduce paperwork, boost transparency, and decrease instances of fraud. Most importantly of all, they will enable businesses to pay each other (and end customers) quickly, and at minimal or even zero cost, no matter where in the world they are. That has massive potential for the future – for all of us.

On balance, the positives far outweigh the negatives. They genuinely have the potential to generate significant benefits for every business that needs to send a cross-border payment.

Cre: Ragapay