The automotive industry is on the verge of a revolutionary transformation, driven by innovative advancements in software technology. As we look towards the future, it is clear that software will play a primary role in reshaping the auto industry landscape, from enhancing vehicle connectivity and electrification to leading the development of autonomous driving capabilities.

In this blog, we will explore the key software innovations set to redefine the automotive industry, highlighting the five core beliefs about the auto sector’s transformation and explaining why “co-opetition” is essential for success.

Software Trends in the Coming Years

1. Autonomous Driving Technology

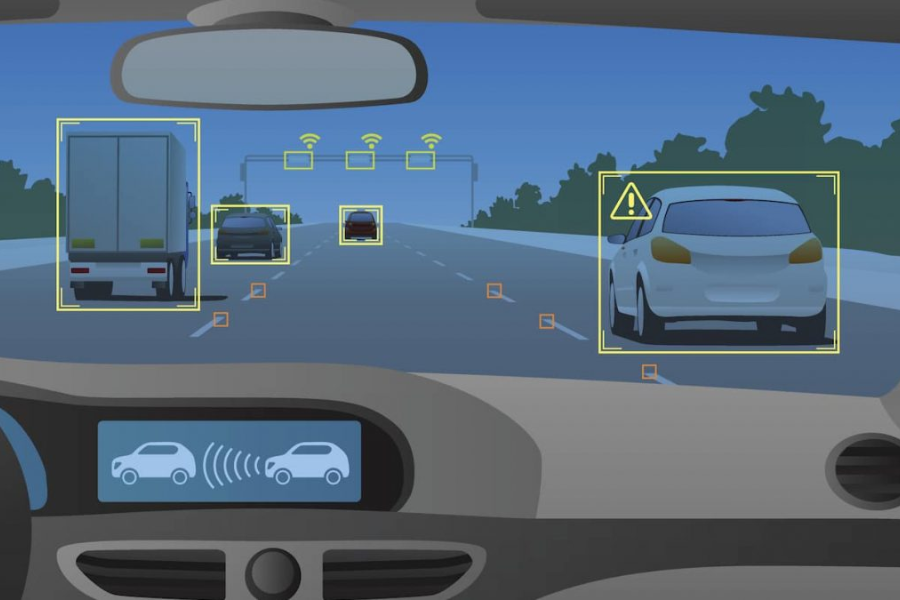

AI and Machine Learning: The development of autonomous driving systems continues to advance, leveraging AI and machine learning for improved safety and reliability. These technologies enable vehicles to make real-time decisions, handle complex driving scenarios, and reduce the risk of human error.

Sensor Fusion: Combining data from multiple sensors (e.g., cameras, LIDAR, radar) will improve the accuracy of autonomous systems.

2. Electric Vehicles (EVs)

Battery Management Systems (BMS): Software innovations in BMS are crucial for optimizing battery performance and extending the lifespan of EV batteries. Enhanced energy optimization techniques and efficient power management will play a significant role in the proliferation of EVs.

3. Connected Vehicles and IoT Integration

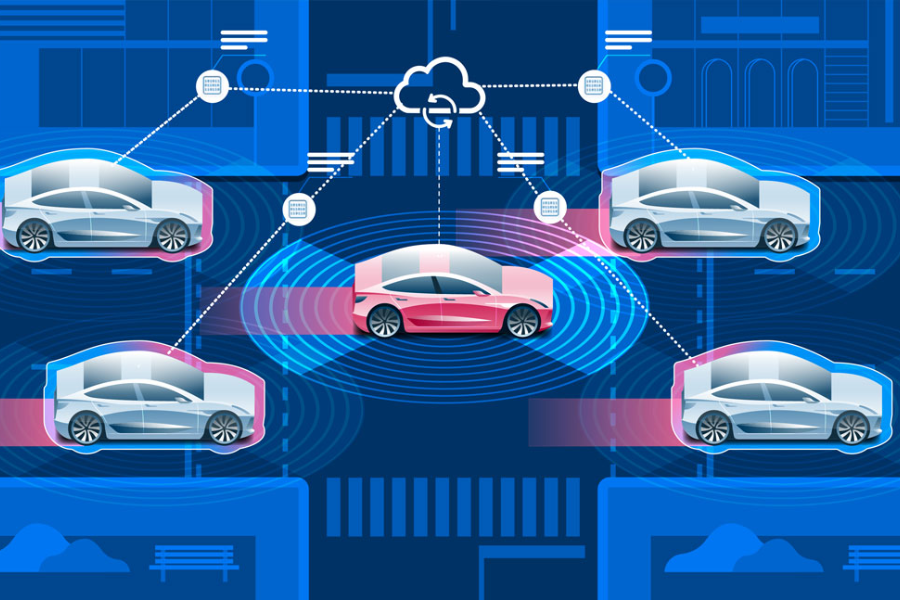

Vehicle-to-Everything (V2X) Communication: V2X technology is set to revolutionize traffic management and safety by enabling communication between vehicles, infrastructure, and other road users. This connectivity will improve traffic flow, reduce accidents, and support the development of smart cities.

4. Over-the-Air (OTA) Updates

Continuous Improvement and Customization: OTA updates allow manufacturers to deliver new features, security patches, and bug fixes remotely. This capability not only enhances vehicle performance and safety but also provides a platform for continuous improvement and customization based on user preferences and feedback.

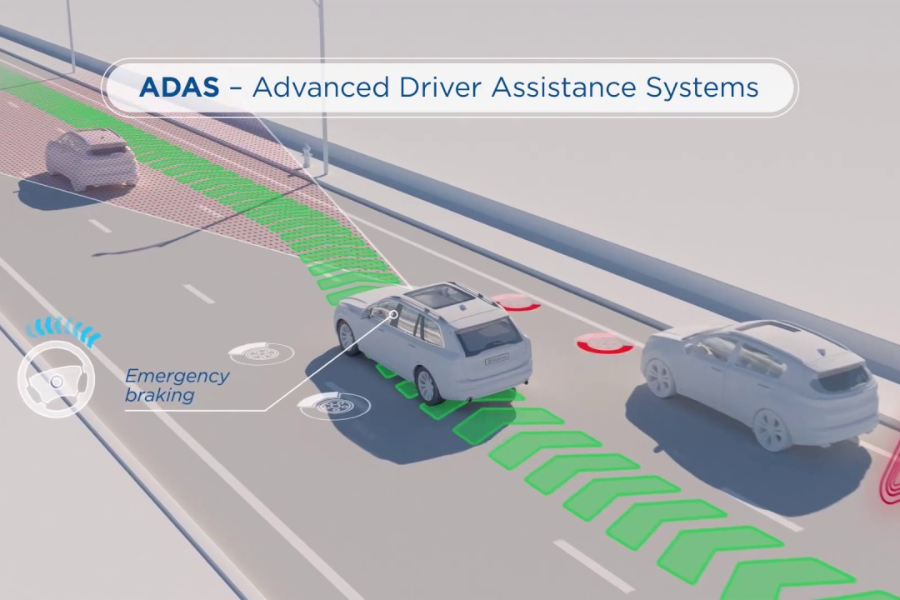

5. Advanced Driver Assistance Systems (ADAS)

Enhanced Safety Features: ADAS technology is evolving with AI integration, offering advanced features such as adaptive cruise control, automatic emergency braking, and lane-keeping assistance. These systems use real-time data processing and machine learning to adapt to dynamic road conditions, significantly enhancing driver safety.

Key Beliefs About the Transformation of the Auto Industry

BCG has developed five core beliefs about the market and industry landscape that will emerge from this period of transformative growth via their market model and independent research on each of the software layers.

1. Consumer Monetization Will Grow to $248 Billion by 2030

The potential for monetizing consumers through the mobility ecosystem and consumer-facing applications is immense for automakers. By offering subscriptions to advanced driver assistance systems (ADAS), automakers can tap into a lucrative market. Consumer monetization is projected to skyrocket from $87 billion in 2023 to an impressive $248 billion by 2030, with the applications layer driving $209 billion of this growth.

This surge in revenue is fueled by two primary factors: The advancement of driver assistance technologies and the shift to subscription models for consumer applications. By 2030, it’s expected that 30% to 60% of consumer-facing applications will be sold via subscriptions, depending on the region.

As consumers tend to stick with brands offering compelling digital services and customized software, Original equipment manufacturers (OEMs) benefit greatly from increased customer loyalty.

To take these opportunities, automotive OEMs must adopt best practices from the telecommunications and tech sectors, such as effective up-selling, cross-selling, and issue resolution techniques. Additionally, they must develop the technical infrastructure to support continuous updates of consumer-facing software, leveraging over-the-air updates and high-performance computing platforms to deliver seamless experiences.

2. Autonomous Vehicles Will Contribute $305 Billion to Software and Electronics Revenues, the Largest Share of This Market Expansion

Assisted and automated driving technologies will drive significant market growth. ADAS and automated driving (AD) systems have the greatest potential among all software-related features. By 2030, it is estimated to contribute $305 billion in revenue across the entire software and electronics segment, including applications, data, and software platforms, compute, and vehicle platforms. Of this amount, the consumer segment will contribute $150 billion through the application layer. The supplier segment will contribute $155 billion across the board.

Customer demand for autonomous vehicles is high —60% of middle-income individuals express a desire to own one. Meeting customer demand is especially important for premium OEMs, as more than 70% of high-income consumers say they prefer autonomous vehicles.

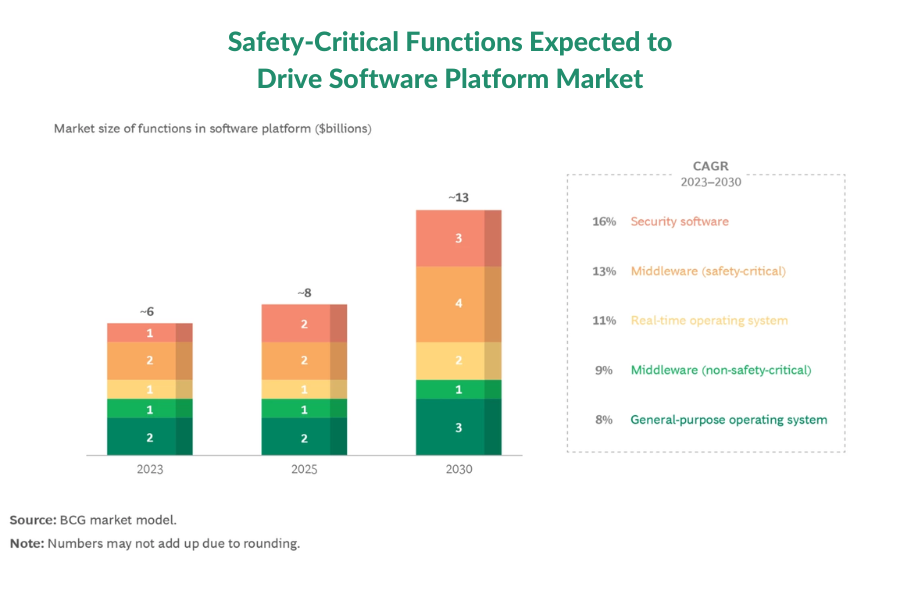

3. Software Platforms Will Account for 2% of the Market, Requiring Scalability Across Automakers

It is predicted that the software platform market will account for only 2% of the total software and electronics automotive market by 2030. It will have a CAGR of 12% from 2023 through 2030, growing to $13 billion. The key contributor to this growth will be safety-critical software, driven by the adoption of ADAS/AD systems. Although safety-critical software currently accounts for only half of the market, it will account for 70% in 2030.

There is an ongoing paradox with software platforms. This layer is one of the most unstable parts of the stack, leading to millions of bugs and malfunctions in cars. Yet most OEMs still prefer to build software platforms in-house, rather than using external solutions from specialized vendors. In these efforts, they rely heavily on open-source software (the investment involved is not evident in the market forecast). In fact, many large vendors and technology companies have considered entering the market but are deterred by the low current value.

Industry participants should be keenly interested in developing a more sustainable, industry-wide solution. Developing an open-source, industry-scale platform could be the answer, but the challenge lies in identifying the best party to do this: an OEM, supplier, tech firm, or consortium.

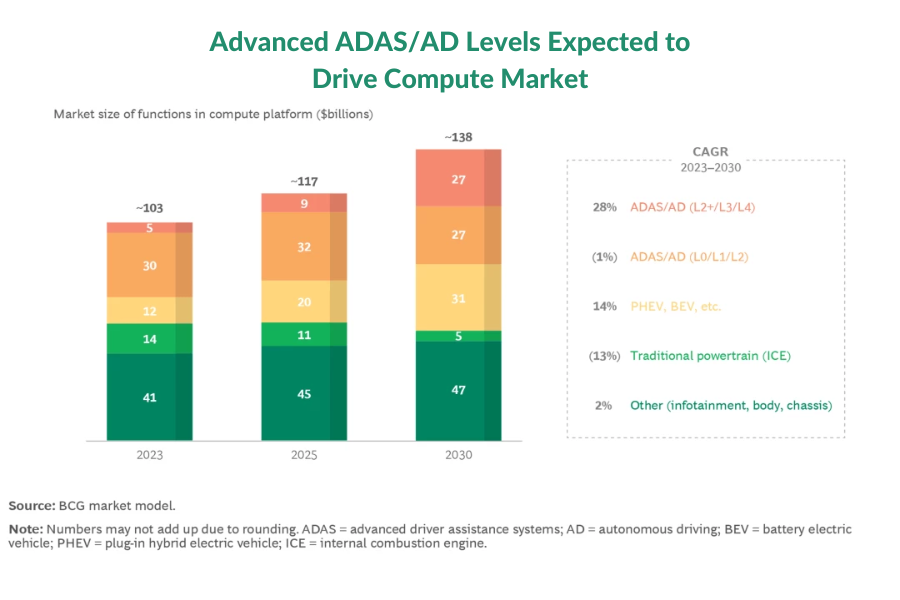

4. Compute Platforms Will Be a $138 Billion Market with Driver Assistance and Infotainment Driving Centralized Architectures

The computing platforms market is projected to grow from $103 billion today to $138 billion by 2030, marking a 4% CAGR. The primary growth driver will be the adoption of higher levels of ADAS/AD (L2+, L3, and L4), which alone is expected to reach $27 billion in 2030, representing a 25% to 30% CAGR. The rise in electric vehicle adoption will also contribute significantly, with the market for electric powertrains projected to hit $31 billion by 2030.

By 2030, DCUs are expected to constitute 40% to 50% of the market value, predominantly supporting ADAS/AD and infotainment, which will account for 80% to 90% of the DCU market. Following this, DCUs and centralized computing will be increasingly adopted for powertrain, body, and chassis applications. While the overall compute platform market may see moderate growth, specific segments like DCUs and system-on-a-chip will experience above-average growth, overshadowing other subsegments.

These shifts highlight the critical importance for semiconductor companies to lead innovation. Recent strategic collaborations and advancements in chip development for higher ADAS/AD levels emphasize the need for continual innovation in this fast-evolving landscape.

5. Collaborating with Local Champions is Essential to Tap into China’s Market, Surpassing $200 Billion by 2030

The need for customization in the automotive software industry is driving the rise of local champions, particularly in China. Region-specific software solutions are becoming essential to meet unique customer preferences and government requirements, such as data collection, high-definition map development, and ecosystem features.

Currently, automotive software spending per vehicle in China is significantly lower than in Western markets due to slower adoption rates of key technologies and lower price levels—55% to 70% of European and US prices. As a result, the average consumer spending on automotive software in China is less than $1,000 per new car sold.

By 2030, this scenario will change dramatically. China will catch up with Western markets in ADAS/AD adoption, and price levels will rise to 85% to 90% of those in Western markets. Although subscription model adoption may remain lower in China, these developments will drive average consumer spending on automotive software to exceed $2,500 per new car sold.

In 2030, the Chinese automotive market is expected to exceed $200 billion, accounting for more than 30% of global growth. The consumer and supplier markets will generate $80 billion and $125 billion in revenues, respectively. China’s rapid AD adoption, high share of BEVs, and sales volume exceeding 30 million cars will drive this growth, which is expected to continue robustly beyond 2030. The substantial market size will enable local players to achieve critical scale and form their own ecosystem, somewhat independent of global influences.

The recent Shanghai auto show showcased that Chinese OEMs and their supplier ecosystem have surpassed Western counterparts in speed, quality, price, and functionality. Chinese start-up OEMs, leveraging advanced E/E architectures and software, are innovating at a much faster pace and are poised to capture significant global market share. This dynamic may heighten geopolitical tensions and dependencies. For Western ecosystem participants, these developments underscore the urgency of understanding their own strengths, forming strategic partnerships, and identifying joint opportunities. The collaboration between Ford and Baidu exemplifies such strategic partnerships.

Thriving in the Evolving Market Demands Strategic “Co-opetition”

No player can single-handedly conquer the software and electronics market. The various challenges—such as inadequate technological capabilities, lack of scale, limited access to end customers, and local market differences—are too formidable. Each of our five core beliefs is implicated. For example, to capture consumer revenue, OEMs and big tech players must combine capabilities and assets, such as end-customer access or experience in developing and deploying consumer-facing technologies.

Consequently, the industry is set to witness a surge in new partnerships and supplier deals, including collaborations between auto and tech companies, and between tech firms themselves. As their capabilities gain importance, we expect to see emerging tech players capture significant parts of the market. In 2030, up to $350 billion will be at stake, with traditional auto players and emerging tech players all seeking their share. In this context, companies will gain a competitive advantage by jointly creating offers that combine their capabilities and assets. This approach requires a blend of competition and cooperation, hence the term “co-opetition.”